The newest 7th CPC Household Strengthening Advance provides reasonable rates and rebates if certain standards are fulfilled. You will find other rates of interest for various slabs out of funds. Addititionally there is a max admissible matter and particular regulations.

What is actually Domestic Strengthening Advance?

Family Strengthening Get better (HBA) exists so you can personnel of the Central Bodies to help with the development otherwise purchase of home/flats. The fresh design was first circulated when you look at the 1956 in the form of a passions measure. The newest Ministry out of Metropolitan Development ‘s the nodal Ministry to possess using a similar. Brand new Ministry and additionally formulates the principles regarding the Domestic Strengthening Progress.

HBA is offered to all or any long lasting or temporary group which have services out of 10 continuous years or maybe more. The respective divisions are offered the power so you can approve House Building Get better to help you professionals in line with the current regulations.

Interest into the Family Strengthening Progress

HBA is actually in the an easy interest throughout the date from payment of the improve matter. The attention count are calculated according to research by the outstanding harmony with the the very last day’s the day. The speed towards HBA is actually ranging from six% and nine.5% in fact it is based on the amount borrowed.

A top rate of interest was specified about sanctions, on 2.5% over the given prices. Brand new staff get a discount toward rates of interest when the he/she meets the following conditions:

- dos.5% promotion is applicable on the HBA financing in the event your requirements related to new approve of progress and you will recovery of your own entire matter is found entirely.

- 0.5% interest is out there so you’re able to a worker which goes through voluntary sterilisation. A comparable rate is even open to a worker when the their/their unique mate experiences sterilisation.

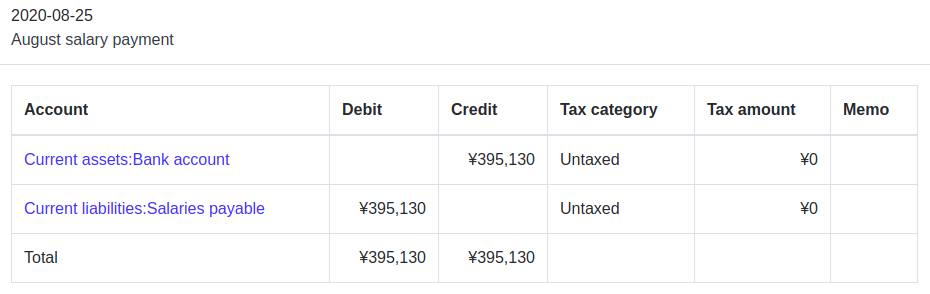

- The important points of improve try as shown about table below:

Family Building Get better Maximum Admissible Count

- The recuperation of your HBA would-be built in lower than 180 monthly payments. The interest is recovered in under sixty monthly payments also. In the event the government employee are retiring just before 2 decades, the costs will be carried out in payments easier so you’re able to your/their own. The balance normally paid off about Old-age Gratuity.

- Its required that regulators personnel provides our home given that in the near future once the buy/design is completed towards Term life insurance Enterprise out of India otherwise any kind of their relevant systems. The insurance is extracted from any of the accepted individual insurance vendors. It needs to be detailed your contribution in hopes in insurance rates shouldn’t be lower than the degree of improve sent to flames destroy, super, flooding, etcetera. The insurance must also remain before improve and you will notice try totally reduced by the worker.

- The house are mortgaged towards the fresh President out of Asia contained in this a particular stage, except if the head of Service of staff has an extension over time. Adopting the get better and you can appeal amounts are Sheffield loans paid back, the borrowed funds action was lso are-shown.

Household Strengthening Allocation application form

- The new land/house control is going to be clear, and it is going to be in the title of staff member or his/their own spouse.

- The newest applicant off his/their particular mate should not keeps a separate homes/house/apartment whenever you are submission the application form into the HBA. However if he has got a minor youngster, he/she must not have a property/land/flat.

- The advance will be utilised to create a full time income place otherwise purchase home on which our home was depending.

7th Shell out Payment suggestions – Walk in-house Strengthening Allowance

In , the us government changed our home Strengthening Allotment (HBA) statutes to own Main Regulators teams in an attempt to boost the housing sector in the country. The advice from this new 7th Pay Commission had been recognized and you may adopted. Towards the the brand new legislation in position, a member of staff of your Main Regulators are now able to borrow money out of Rs.twenty five lakh to possess strengthening a house. The 2009 amount try Rs.eight.5 lakh.